BTC to GBP: The Complete Guide to Understanding Bitcoin’s Value in British Pounds

BTC to GBP it comes to cryptocurrency, one of the most talked-about and widely traded digital assets is Bitcoin. Whether you’re an investor, a trader, or simply curious about digital currencies, knowing how Bitcoin converts to traditional fiat currencies is essential. Among the most commonly asked questions is the value of it — in other words, how much a Bitcoin is worth in British Pounds. This guide will explore everything you need to know about it, including how it’s calculated, what affects the exchange rate, and why it matters to crypto enthusiasts in the UK.

What Is BTC and Why Is It Important?

Bitcoin, often abbreviated as BTC to GBP, is the original cryptocurrency that started it all. Created in 2009 by the mysterious figure known as Satoshi Nakamoto, Bitcoin was designed as a peer-to-peer digital cash system. It’s decentralized, meaning it operates without a central authority or bank. This unique feature has made it both revolutionary and controversial.

The importance of BTC goes beyond just being the first of its kind. It’s widely considered digital gold due to its scarcity, security, and store-of-value properties. Many investors treat it as a hedge against inflation and a potential long-term investment, while others consider it a speculative asset. Regardless of how you view it, there’s no denying that Bitcoin has reshaped the way we think about money and finance.

Understanding the GBP: The British Pound at a Glance

GBP stands for the Great British Pound, also known as the pound sterling. It’s one of the oldest currencies still in use today and is considered one of the most stable fiat currencies in the world. Managed by the Bank of England, the GBP is a key player in global finance.

When you look at the it exchange rate, you’re essentially comparing the value of a decentralized digital currency with a government-backed traditional one. This pairing is crucial for UK residents who want to trade or invest in Bitcoin, as it helps them understand their returns in a familiar currency.

How BTC to GBP Exchange Rates Work

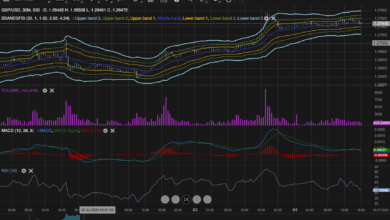

The BTC to GBP exchange rate tells you how many British Pounds one Bitcoin is currently worth. Unlike fiat currency exchange rates, which are influenced primarily by central bank policies and trade balances, Bitcoin’s price is driven by market demand and supply.

Crypto exchanges like Binance, Coinbase, and Kraken provide real-time conversion rates. These platforms aggregate buy and sell orders from users across the globe, and the resulting price is the last price at which a trade occurred. Because cryptocurrency markets operate 24/7, the BTC to GBP rate is constantly changing.

Factors That Influence the BTC to GBP Rate

Several key elements affect the exchange rate between BTC and GBP. Understanding these can help you make more informed decisions when trading or investing.

One major factor is market sentiment. When news about Bitcoin is positive, like a large company accepting BTC as payment or a country legalizing crypto, demand rises, pushing up the price. On the flip side, regulatory crackdowns or security breaches can lead to a sharp decline.

Another critical element is the overall strength of the British Pound. Economic indicators such as inflation rates, interest rates, and political stability in the UK can make the pound stronger or weaker, which in turn affects the BTC to GBP conversion.

BTC to GBP Conversion Tools and Platforms

If you’re looking to convert BTC to GBP, there are plenty of tools and platforms to help you. Online calculators allow you to enter a BTC amount and get the current GBP equivalent instantly. These tools are incredibly useful for quick checks and planning.

Cryptocurrency exchanges are your go-to option for actual conversions. When you create an account and verify your identity, you can deposit BTC and then sell it for GBP. The funds can then be withdrawn to your bank account. Always check the fees involved, as they can vary significantly from one platform to another.

Why the BTC to GBP Pair Is Important for UK Traders

For UK-based crypto traders, keeping an eye on the BTC to GBP pair is crucial. It directly impacts how much profit or loss they make from trades. Since many platforms show prices in USD, using the BTC to GBP rate helps local investors get a more accurate financial picture.

Moreover, knowing the conversion rate helps with tax calculations. In the UK, cryptocurrency is subject to Capital Gains Tax, and understanding your transactions in GBP ensures you stay compliant with HMRC guidelines.

Historical Trends of BTC to GBP

Looking at the historical trends of BTC to GBP can offer valuable insights. Over the years, Bitcoin has experienced extreme volatility. There have been times when BTC skyrocketed in value, making headlines around the world. There have also been moments of sharp correction, reminding everyone of the risks involved.

Historical data shows that despite the ups and downs, the general trend has been upward. If you had invested in BTC five years ago and converted it to GBP today, chances are you’d see significant returns. However, past performance is not a guarantee of future results, so caution is always advised.

Comparing BTC to GBP vs BTC to USD

Many global crypto news sites and exchanges default to BTC to USD prices, which can be confusing for UK residents. Comparing BTC to GBP versus BTC to USD gives you a clearer understanding of local vs international pricing.

While the USD remains the global benchmark, the GBP offers a more relevant conversion for those living and spending in the UK. Plus, exchange rates between the USD and GBP can further influence how Bitcoin prices appear in local currency.

How to Securely Convert BTC to GBP

Converting BTC to GBP isn’t just about getting the best rate; it’s also about staying safe. Cryptocurrency is a high-risk environment, and scams are unfortunately common. Stick to reputable platforms with strong security features.

Look for exchanges that offer two-factor authentication, cold storage for funds, and a transparent fee structure. It’s also a good idea to enable withdrawal whitelists and monitor your accounts regularly.

If you’re cashing out a significant amount, consider consulting a financial advisor or tax specialist to ensure you’re making smart moves. Crypto can be exciting, but it’s easy to overlook important details when big money is involved.

Real-World Uses of BTC to GBP Conversion

You might wonder why someone would convert BTC to GBP instead of just holding onto their Bitcoin. The answer lies in real-world usage. Some people use BTC as a form of savings and only convert when they need to make a large purchase or cover unexpected expenses.

Others trade actively and need to move in and out of fiat currencies frequently. Whether it’s buying a house, funding a business, or even paying for tuition, having the ability to convert BTC to GBP gives Bitcoin real utility beyond just being a digital asset.

The Future of BTC to GBP

The future of BTC to GBP is tied closely to the future of Bitcoin itself and the UK’s evolving stance on cryptocurrency. As adoption grows and regulations become clearer, the market will likely mature, leading to more stable prices and greater trust.

There is also increasing interest from institutional investors, which could further drive demand. Combine that with technological advancements like the Lightning Network, and you have the recipe for a more seamless BTC to GBP conversion process.

FAQs About BTC to GBP

What is the current BTC to GBP rate?

The BTC to GBP rate changes constantly due to market fluctuations. You can check live rates on crypto exchanges or financial websites that track cryptocurrencies.

Is it safe to convert BTC to GBP online?

Yes, as long as you use reputable and secure platforms. Always enable security features and be cautious of phishing scams.

Are there fees when converting BTC to GBP?

Most platforms charge a fee, which can include trading fees, withdrawal fees, and spread. Make sure to read the fee structure before proceeding.

Can I convert a small amount of BTC to GBP?

Absolutely. Many platforms allow you to convert even tiny fractions of a Bitcoin. This is ideal for those who are just getting started or testing the waters.

Does the BTC to GBP rate include taxes?

No, the conversion rate itself doesn’t include taxes. However, you may be liable to pay tax on any gains, depending on your country’s laws.

What is the best time to convert BTC to GBP?

There is no one-size-fits-all answer. Watch market trends and news, and consider converting when prices are favorable to you.

Can I receive GBP directly into my bank account?

Yes, once you sell your BTC for GBP on an exchange, you can usually withdraw the funds directly to your bank account.

What are the risks of converting BTC to GBP?

Risks include market volatility, exchange security, and regulatory changes. Always do your research and take appropriate precautions.

Do I need to report BTC to GBP conversions to HMRC?

Yes, in most cases. If you’re realizing a gain, you’ll need to report it on your tax return. Keep accurate records of your transactions.

Can I automate BTC to GBP conversions?

Some platforms allow you to set up recurring sales or price triggers. This can help automate the process based on your investment strategy.