A Comprehensive Guide to Tumblr Login: Everything You Need to Know

Tumblr Login microblogging and social media platform, has been a hub for creative expression since its launch in 2007. Whether you’re an artist, writer, or casual user, logging into Tumblr is your gateway to sharing content, connecting with communities, and exploring niche interests. But before diving into the vibrant world of Tumblr, it’s essential to understand how the login process works.

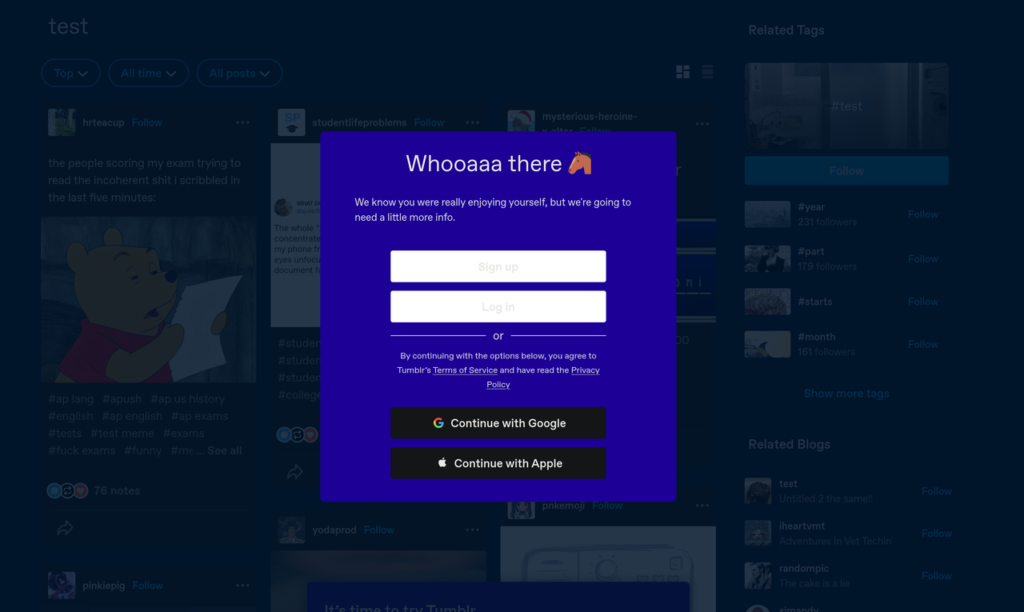

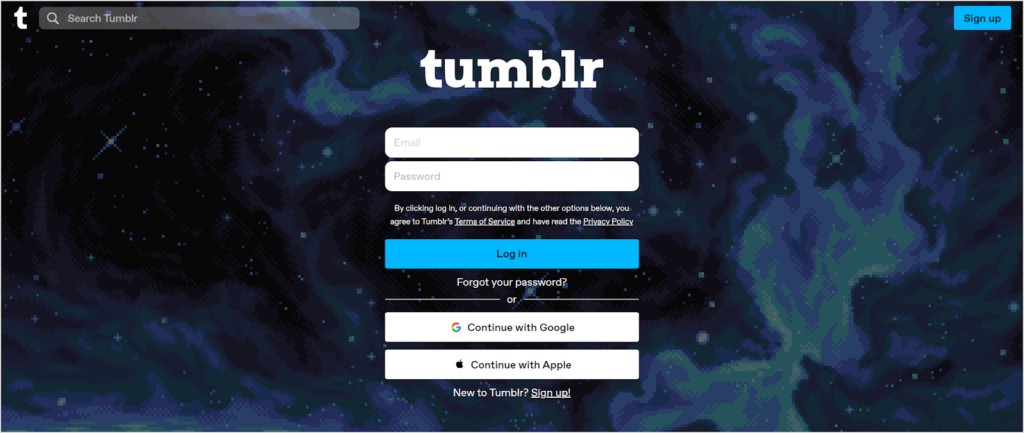

To access your Tumblr Login account, you need a registered email address or username and a password. Tumblr also allows users to sign in via third-party platforms like Google, Apple, or even a phone number, depending on your region. The login page is straightforward: navigate to Tumblr.com, click “Log In” in the top-right corner, and enter your credentials. If you’re a new user, the “Sign Up” option will guide you through creating an account.

Security is a critical aspect of the Tumblr login process. The platform employs encryption protocols to protect user data during transmission. However, users must also take responsibility for safeguarding their passwords. Avoid using easily guessable passwords like “123456” or “password.” Instead, opt for a combination of uppercase and lowercase letters, numbers, and symbols. Enabling two-factor authentication (2FA) adds an extra layer of security, ensuring that even if your password is compromised, unauthorized access is prevented.

Step-by-Step Guide to Logging into Tumblr

Logging into Tumblr is a simple process, but newcomers or those returning after a long hiatus might need a refresher. Below is a detailed breakdown of how to access your account on both desktop and mobile devices.

Desktop Login Process

- Open your preferred web browser and go to www.tumblr.com.

- Click the “Log In” button located at the top-right corner of the homepage.

- Enter your email address, username, or phone number associated with your Tumblr account.

- Type your password in the designated field. Ensure caps lock is off if your password is case-sensitive.

- Click “Log In” to access your dashboard.

If you’ve enabled two-factor authentication, you’ll be prompted to enter a verification code sent to your registered device or authentication app. This step ensures that only authorized users can access the account, even if someone else knows the password.

Mobile App Login Process

- Download the Tumblr app from the Apple App Store or Google Play Store.

- Open the app and tap “Log In” on the welcome screen.

- Input your email, username, or phone number.

- Enter your password and tap “Log In.”

- Complete two-factor authentication if enabled.

The mobile app offers a seamless experience, allowing you to stay connected to your blog, reblog posts, and interact with followers on the go.

Troubleshooting Common Tumblr Login Issues

Despite its user-friendly design, Tumblr users occasionally encounter login problems. These issues can range from forgotten passwords to technical glitches. Below are solutions to the most common challenges.

Forgotten Password

If you’ve forgotten your Tumblr password, follow these steps:

- On the login page, click “Forgot Password?”

- Enter your email address or username linked to the account.

- Check your inbox for a password reset link from Tumblr.

- Click the link and create a new password.

Ensure the new password is unique and not reused from other accounts. If you don’t receive the reset email, check your spam folder or request another link.

Account Locked or Hacked

Unauthorized access to your Tumblr account can be alarming. If you suspect hacking:

- Use the “Forgot Password?” tool to regain control.

- Contact Tumblr Support via their Help Center.

- Review connected third-party apps and revoke access to suspicious ones.

Tumblr’s support team typically responds within 24–48 hours. To prevent future breaches, enable 2FA and avoid sharing login details.

Browser or App Errors

Technical issues like outdated browsers, cached data, or app bugs can hinder login attempts. Try these fixes:

- Clear your browser’s cookies and cache.

- Update the Tumblr app or browser to the latest version.

- Switch to a different browser or device.

If problems persist, Tumblr’s Status Page provides real-time updates on server outages or maintenance.

Enhancing Security for Your Tumblr Account

Securing your Tumblr account goes beyond creating a strong password. Here’s how to protect your blog and personal information from threats.

Two-Factor Authentication (2FA)

2FA requires a secondary verification method, such as a text message code or authentication app. To enable it:

- Go to Account Settings > Security.

- Click “Turn On Two-Factor Authentication.”

- Follow the prompts to link your phone or authentication app.

Monitoring Login Activity

Tumblr allows users to review recent login sessions. Navigate to Settings > Security to view locations and devices that accessed your account. Log out of unrecognized sessions immediately.

Avoiding Phishing Scams

Phishing emails or fake login pages mimic Tumblr’s interface to steal credentials. Always verify URLs before entering your details. Legitimate Tumblr links start with https://www.tumblr.com/.

Managing Multiple Tumblr Accounts

If you run several blogs—for personal use, hobbies, or business—Tumblr lets you switch between accounts effortlessly.

Adding a Secondary Account

- Click your profile icon on the dashboard.

- Select “Add Account” and enter the credentials for the second blog.

- Toggle between accounts via the profile menu.

Using Third-Party Apps

Apps like Twitual or XKit (unofficial) offer tools for managing multiple blogs. However, exercise caution when granting third-party access to your account.

Tumblr Login for Developers and API Access

Developers integrating Tumblr’s API into apps or websites must authenticate via OAuth 2.0. This process involves:

- Registering an application on Tumblr’s Developer Portal.

- Obtaining API keys and secrets.

- Redirecting users to Tumblr’s authorization page.

API documentation provides detailed guidelines for secure implementation.

FAQs: Tumblr Login Questions Answered

Q1: Can I log into Tumblr without a password?

A: Yes! Use third-party services like Google or Apple to sign in without a password.

Q2: Why isn’t my Tumblr login working?

A: Common causes include incorrect credentials, server outages, or 2FA issues. Reset your password or check Tumblr’s Status Page.

Q3: Is Tumblr login free?

A: Absolutely. Creating and accessing a Tumblr account is free.

Q4: How do I recover a deleted Tumblr account?

A: Contact Tumblr Support within 30 days of deletion. After that, recovery is impossible.

Q5: Can I stay logged into Tumblr on multiple devices?

A: Yes, but logging out of unused devices enhances security.