Pound to Euro: Everything You Need to Know About the Currency Conversion

pound to euro conversion is something that affects millions of people every year. Whether you’re planning a European getaway, shopping online from European retailers, or managing a business with ties to the EU, the pound to euro rate is a key factor that influences spending decisions. This article breaks down the essentials, offers insights, and answers your burning questions, all with a friendly yet knowledgeable touch.

Understanding the Pound to Euro Exchange Rate

The pound to euro exchange rate is essentially the value of one British pound when converted into euros. This rate fluctuates constantly based on economic, political, and market factors. So if you’re wondering why your money doesn’t go as far today as it did last month, you’re not alone.

At its core, the rate is influenced by supply and demand in the foreign exchange markets. When demand for the pound increases, so does its value against the euro. Conversely, when investors prefer the euro, the pound can lose ground. Simple in theory, complex in execution.

Why the Pound to Euro Rate Changes

Several factors influence why the pound to euro exchange rate can swing dramatically in a short time. These include interest rate decisions from the Bank of England or the European Central Bank, inflation data, and even political stability. Yes, even a single speech from a political figure can nudge the rate in either direction.

Global events, like a pandemic or war, can also wreak havoc on currency values. Traders react quickly to global headlines, and this sentiment is reflected in currency pairings like the pound to the euro. Keeping an eye on economic calendars can help you anticipate potential movements.

Best Time to Convert Pound to Euro

Timing your currency conversion can make a big difference, especially if you’re converting large amounts. While no one can predict the future with certainty, historical trends can give you a good idea. For example, the pound to euro often sees a bump during the summer tourist season or around major political events.

A smart move is to monitor trends and set alerts with financial apps or brokers. Some platforms even let you lock in rates in advance, which is helpful if you’re worried the pound to euro rate might drop before your trip or transaction.

Impact of Brexit on the Pound to Euro

It’s impossible to talk about the pound to euro relationship without mentioning Brexit. The UK’s exit from the EU had significant effects on the pound’s strength. Before the 2016 referendum, the pound was much stronger against the euro. Once the vote happened, uncertainty caused the rate to plummet.

Even now, post-Brexit, the economic implications continue to affect exchange rates. Trade deals, customs policies, and the overall health of the UK and EU economies all play a part. Businesses especially need to stay informed, as sudden changes can impact profits.

Where to Exchange Pounds for Euros

Not all exchange points offer the same rate. Airports, for example, are notoriously bad when it comes to pound to euro conversions. High fees and poor rates make them a last resort.

High street banks, online currency converters, and even prepaid travel cards tend to offer more competitive rates. If you plan, you can shop around for the best value. Websites that compare currency providers can be especially helpful.

Pound to Euro in Travel Planning

If you’re traveling to the eurozone, getting a good pound to euro rate can mean more spending money for your trip. It’s best not to leave your currency exchange until the last minute. Rates at the airport or in tourist hotspots are typically the worst.

Prepaid travel money cards, or ordering cash online for pickup, are popular options. These methods often come with lower fees and better rates. Some travelers even monitor the pound to euro rate weeks in advance and exchange when the rate is favorable.

Pound to Euro and Online Shopping

More people than ever are buying from European websites. But if you’re shopping in euros with pounds, the conversion rate directly affects how much you’re paying. An unfavourable rate can add unexpected costs to your order.

Many credit cards now offer zero foreign transaction fees, which can help if you’re a frequent online shopper. Still, it’s worth knowing what rate your provider uses for pound to euro conversions so you don’t get caught off guard.

Business and the Pound to Euro Rate

For UK-based businesses trading with Europe, the pound to euro rate is more than just a number—it can impact pricing, profits, and planning. Even small changes in the rate can affect the bottom line when large volumes are involved.

Hedging strategies are often used by businesses to protect themselves from unfavorable shifts in the pound to the euro. Currency contracts, forward buying, and diversification are all methods companies use to minimize risk.

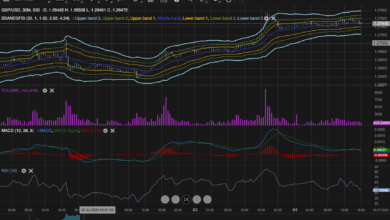

How to Track the Pound to Euro Rate

There are plenty of ways to keep tabs on the pound to euro exchange rate. Financial news websites, currency tracking apps, and even social media accounts focused on forex are all good resources.

Some apps allow you to set alerts for when the pound to euro hits a specific rate. This is especially useful for travelers or investors who want to act fast when the rate is in their favor.

Historical Trends of the Pound to the Euro

Looking at past performance can give you some clues about where the pound to euro might be heading. While history doesn’t always repeat itself, it does often rhyme. The rate has seen plenty of ups and downs, particularly during financial crises or major political shifts.

Long-term graphs show how external events, such as Brexit or the eurozone debt crisis, caused major fluctuations. If you’re planning a big conversion or long-term investment, studying these trends is a wise move.

Pound to Euro Forecasts and Predictions

Currency experts and analysts frequently publish forecasts about where the pound to euro is headed. These are based on economic data, geopolitical developments, and market sentiment. While these predictions are helpful, remember they are not guarantees.

Still, reading these reports can prepare you for potential rate movements. Some financial platforms even summarize expert opinions to give you a consensus view, helping you decide when to make your move.

How Central Banks Affect the Pound to the Euro

The Bank of England and the European Central Bank are big players in the pound to euro exchange rate. Interest rate changes, quantitative easing policies, and economic outlooks from these institutions can send ripples through the currency markets.

Statements from bank governors or shifts in policy often have immediate effects. Traders watch these closely, and so should you if you want to stay ahead of the pound-to-euro game.

Tips for Getting the Best Pound to Euro Rate

Getting the best value means being proactive. Don’t just accept the first rate you see. Compare different providers, avoid hidden fees, and consider timing your conversion for when the pound to euro rate is more favorable.

Using digital tools, reading expert analysis, and learning a bit about how forex markets work can go a long way. Even small improvements in your exchange rate can add up, especially over time or for larger sums.

Pound to Euro Conversion for Expats

For expats living in the eurozone but earning in pounds, fluctuations in the exchange rate can impact daily life. Rent, groceries, and bills paid in euros mean you’re constantly converting your income.

Some expats use international bank accounts or online platforms to convert money at better rates. Regularly transferring money means you’ll want a service that offers reliability and good pound-to-euro value.

Mobile Apps for Pound to Euro Exchange

Mobile apps have made it easier than ever to manage currency conversions. From real-time tracking to low-fee exchanges, there’s no shortage of options. Revolut, Wise, and XE are a few that offer good pound-to-euro features.

Many apps also allow you to hold balances in multiple currencies, which is great for travelers or international freelancers. Always read reviews and understand the fee structure before choosing an app.

FAQs About Pound to Euro

What affects the pound to euro exchange rate the most?

Interest rate changes, inflation data, political events, and central bank decisions are major factors.

Is it better to convert pounds to euros in the UK or abroad?

Generally, you’ll get better rates in the UK if you plan. Avoid airport exchanges when possible.

Can I lock in a pound to euro rate?

Yes, some services allow you to lock in a rate for future use, which can protect you from unfavorable shifts.

Are online exchanges safe for converting pounds to euros?

Reputable platforms are safe, especially those regulated by financial authorities. Always do your research.

How often does the pound to euro rate change?

It changes constantly during market hours, based on real-time trading activity.

Can I exchange pounds to euros at the post office?

Yes, UK post offices offer currency exchange services, but rates may vary by location.

What’s a good pound to euro rate?

This depends on market conditions, but anything significantly higher than the current average is generally considered good.

How can I avoid fees when converting currency?

Use fee-free cards, online platforms with no hidden charges, or prepaid travel cards with locked-in rates.

Should I convert all my travel money at once?

It depends on the current rate and how much risk you’re willing to take. Some travelers convert a portion now and the rest later.

Why do airports offer such poor pound to euro rates?

They rely on convenience and foot traffic, so they often charge more and offer worse rates.